Peter LaMastro Real Estate

Connecticut Real Estate

buy | sell | invest

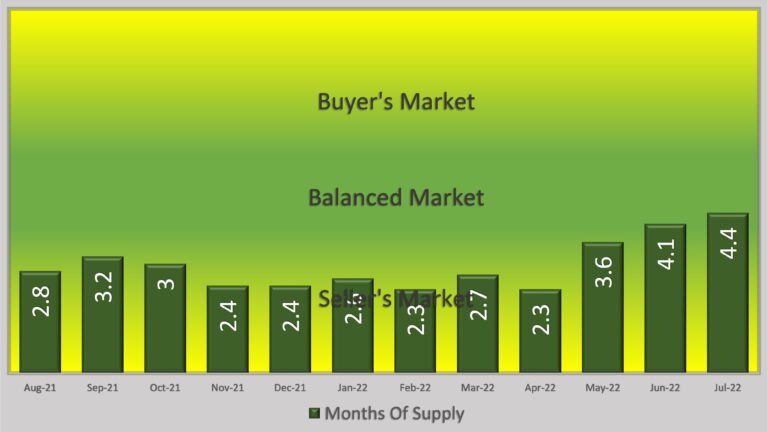

The housing market in Easton slowed somewhat in July compared to previous months. The median sales price dropped 12.16% from $962,000 in June to $845,000. However home values are still up nearly 24% from 1 year ago and up 34.13% since January. February and March have so far seen the highest home values for the year with a median sales price at around $1,070,000. The number of homes that sold also decreased in July from 14 the previous months to 7. That’s a noticeable decrease considering each month had 41 homes on the market. Days on market, the number of days it takes for a home to have an accepted offer go to contract, increased slightly from 24 days in June to 27 days in July, which is still quite low. Last Summer saw around 30 to 36 days and homes were on the market for between 46 to 55 days over the Winter. While Easton has been experiencing a seller’s market for the last year and a half, the months of supply (which indicates a buyer’s, seller’s or balanced market), in July continued it’s upwards trend since May, reaching 4.4 months of supply. Below 4 months indicates a seller’s market while 4 – 6 months indicates a balanced market. While Sellers can still take advantage of phenomenal growth in home values, this is good news for buyers who are still looking to purchase in Easton. High home values and a jump in interest rates have made affording a home a challenge for many buyers. The 30 year fixed interest rate was around 2.87% a year ago, by June it had spiked to 5.81% before dropping to 4.99% by months end. The first week of August saw another rise back to 5.22%. Sellers on average received slightly higher than asking price for their homes, as the list price to sales price ratio was 101.6%. Pending sales rose slightly from 7 in June to 10 in July which could indicate somewhat stronger sales in August. For anyone considering a move, this is a great time to sell a house in Fairfield. Do you know anyone looking for more information about their real estate market? I’d be happy to help.

(change from previous month)

| Current Month | Previous Month | 12 month ago | |

| Median Sale Price: | $845,000 | $962,000 | $682,000 |

| change: | -12.16% | 23.90% | |

| YTD change: | 34.13% | ||

| Units Sold: | 7 | 14 | 14 |

| change: | -50.00% | -50.00% | |

| Active Listings: | 41 | 41 | 43 |

| change: | 0.00% | -4.65% | |

| New Listings: | 16 | 20 | 11 |

| change: | -20.00% | 45.45% | |

| Days on Market: | 27 | 24 | 36 |

| change: | 12.50% | -25.00% | |

| Months of Supply: | 4.4 | 4.1 | 3.1 |

| change: | 7.32% | 41.94% |

The Absorption Rate, also know as Months Of Supply, is a great measure of the current market conditions. It indicates the number of months it would take the current number of houses on the market to sell if no additional houses came on the market. A months of supply under 4 is considered a seller’s market. Between 4 – 6 months would be a balanced market while over 6 months is considered a buyer’s market.

| Curent Month | Previous Month | Change | |

| Bethel | $535,000 | $500,000 | 7.00% |

| Bridgeport | $320,000 | $329,500 | -2.88% |

| Brookfield | $535,000 | $710,000 | -24.65% |

| Danbury | $445,000 | $440,000 | 1.14% |

| Easton | $845,000 | $962,000 | -12.16% |

| Fairfield | $887,000 | $940,100 | -5.65% |

| Milford | $446,825 | $450,000 | -0.71% |

| Monroe | $618,250 | $610,000 | 1.35% |

| Newtown | $550,000 | $677,000 | -18.76% |

| North Haven | $393,500 | $410,500 | -4.14% |

| Orange | $475,000 | $545,000 | -12.84% |

| Oxford | $432,000 | $490,000 | -11.84% |

| Redding | $777,500 | $968,100 | -19.69% |

| Ridgefield | $1,007,500 | $926,000 | 8.80% |

| Seymour | $368,750 | $307,600 | 19.88% |

| Shelton | $503,500 | $479,708 | 4.96% |

| Stratford | $395,000 | $415,000 | -4.82% |

| Trumbull | $526,400 | $570,000 | -7.65% |

| Weston | $1,165,000 | $1,487,500 | -21.68% |

| Westport | $2,070,000 | $2,088,250 | 0.88% |

Double-Digit Home Price Gains in Q2 Erode Affordability Even More: Despite a slowdown in home sales, home prices continue to soar. Eighty percent of 185 major metro markets across the country posted double-digit annual price appreciation in median single-family existing-home sales prices, the National Association of REALTORS®’ latest quarterly report shows. Nationwide, the median single-family existing-home price climbed 14.2% annually, reaching $413,500 in the second quarter. That marks the first time that the median home price has surpassed $400,000, NAR reports. “Home prices have increased at a pace that far exceeds wage gains, especially for low- and middle-income workers,” says NAR Chief Economist Lawrence Yun.

Slowing Inflation Suggests Mortgage Rates Have Topped Out: Inflation eased slightly in July, which could bode well for the housing market in the months ahead, says Lawrence Yun, chief economist for the National Association of REALTORS®. Overall, inflation slowed from 9.1% in June to 8.5% in July, but prices for food and rent continued to climb, the Bureau of Labor Statistics’ Consumer Price Index showed Wednesday. Still, the slight deceleration suggests that consumer price inflation may have peaked, which suggests that mortgage rates also may have peaked, Yun says. The level of inflation “is still high and uncomfortable but may indicate the start of a steady retreat,” Yun adds. Gasoline prices posted a 7% monthly decline, a significant contributor to the recent moderation in inflation. However, prices remain 44% higher than a year ago and 104% higher than two years ago. On Wednesday morning, the 10-year Treasury yield stood at 2.7%. “That should translate into 30-year mortgage rates pulling back to under 5%,” Yun says. “Some recent potential home buyers who were pushed out of the market may now be able to get back in and qualify for a mortgage.”

Almost Half of Mortgaged Homes in US Now Considered Equity-Rich: Nearly half of mortgaged properties were considered equity-rich in the second quarter, meaning owners had at least 50% in home equity. This marked the ninth straight quarterly rise, fueled by soaring house valuations in the pandemic era and an increase in down payments by recent buyers, according to real estate data provider Attom. Although the housing market has cooled recently, the percentage of equity-rich properties will probably keep increasing.

Possible Economic Downturn Likely to Be Mild: The country isn’t officially in a recession yet, despite two consecutive quarters of national contraction of the gross domestic product, a commonly cited indicator of an economic downturn, says Lawrence Yun, chief economist for the National Association of REALTORS®. And several healthy economic trends, including a robust job market, coupled with new efforts to boost affordable housing could stave off a more serious slump, Yun adds. Still, there are questions about whether the U.S. has entered “stagflation,” a period of high inflation combined with an economic slowdown, as many Americans feel the frustrating effects of a slower economy and higher consumer prices. There are two major factors at work counteracting current economic conditions: 1) Robust Job Creation: Each month since the COVID-19 restrictions have been lifted, job creation has been robust. We are now essentially at the same level of jobs and W-2 employment as pre-COVID days. Data shows that there are more job openings than unemployed people, at a ratio of nearly two to one. 2) Commercial Real Estate Growth: The commercial market as a whole is flourishing despite a stagnant office sector. Rental demand is booming, and rents are up significantly. Demand for warehouse space has surged as retailers stock up to avoid supply chain disruptions. Hotel bookings, air travel and park attendance are now above pre-pandemic levels. “The improving construction sector means that any recession will be mild,” Yun said.

Home Buying Is 5% Cheaper Than a Week Ago: Mortgage rates are falling-at least for now-after posting rapid jumps in June. Over the last two weeks, the 30-year fixed-rate mortgage has dropped by one-half of a percentage point. Home buying is about 5% more affordable than a week ago, translating to about $100 less in monthly mortgage payments. Rates are dropping as concerns mount over a possible economic recession, says Sam Khater, Freddie Mac’s chief economist. “While the drop provides minor relief to buyers, the housing market will continue to normalize if home price growth materially slows due to the combination of low housing affordability and an expected economic slowdown,” Khater says. The 30-year fixed-rate averaged 5.30%, dropping from last week’s 5.70% average. Last year at this time, 30-year rates averaged 2.90%.

Majority of Aging Adults Say They’re Not Moving: Baby boomers hold the majority of real estate wealth in the U.S.—and as they age, they increasingly say they plan to stay put in their current homes. Sixty-six percent of U.S. adults aged 55 and older say they expect to age in place, according to a new Freddie Mac survey. But that could further exacerbate the housing supply shortage, the report notes. Baby boomers’ financial gains over the past five years may better equip them to stay in place, however, they acknowledge that their home will require some degree of renovations to make the space more appropriate to age in place. Smart technology is also making the choice easier. According to a study by insurance company The Hartford and the MIT AgeLab, these 10 technologies are making it easier for older Americans to handle home maintenance and safety concerns: Smart smoke and carbon monoxide detectors, Wireless doorbell cameras, Keyless entry, Automated lighting, Smart water shutoff valves, Smart home security systems, Smart outlets and plugs, Smart thermostats, Water and mold monitoring sensors, Smart window blinds.

New-Home Costs Rising at Unparalleled Rate: Inflation is pushing up homebuilding costs at an unprecedented rate, according to Bank of America’s Who Builds the House? report. Supply-chain disruptions and labor shortages are adding pressure to rising prices. The average cost for materials to build a single-family home jumped 42% from 2018 to 2021, according to the report. The median sales price of a new home in April reached a record $450,600, a 20% hike from a year earlier, Commerce Department data shows. Only about 10% of new homes in April on the market were priced at less than $300,000, according to the National Association of Home Builders. A year prior, that share was 25%.

Most Popular Garden Trends for 2022: Love them or hate them, gnomes are the biggest garden trend of 2022, according to a new study from Atlas Ceramics. They analyzed annual Google searches, Instagram posts, and TikTok data to identify the hottest garden trends of the summer. Their top 5 garden trends of 2022 are: garden gnomes, urban gardening, pergolas, bird baths and outdoor rugs & outdoor tiles.

The U.S. Surgeon General said it years ago. He even wrote a book about it — published shortly before the pandemic hit. Americans are experiencing an epidemic of loneliness.

“It can feel like being stranded, abandoned or cut off from the people to whom you belong — even if you’re surrounded by other people. What’s missing when you’re lonely is the feeling of closeness, trust and the affection of genuine friends, loved ones and community,” wrote Vivek Murthy, M.D. in Together: The Healing Power of Human Connection in a Sometimes Lonely World.

Self-isolation during the pandemic has increased public discussion about the private experience of loneliness, which is a good start. Here are a few things we can do individually to alleviate loneliness.

Volunteer: Volunteering is a great way to meet new people. Being around others is uplifting by itself, and you’ll feel good about doing something meaningful.

Quality Over Quantity: The antidote to your loneliness is likely right in your phone contacts. You don’t need to make a bunch of new friends or join a club. Think about the loved ones who are already in your life.

Reassess Relationships: Step back and re-evaluate what you want in a relationship. If you concede boundary issues or other problems, consider having an honest conversation with the person in question. You may conclude that the pair-up isn’t working for you anymore.

Adopt a Dog or a Cat: Find a sweet, furry friend to keep you company at home. Pets are loyal pals for life.

Exercise Outside: Exercise is known to improve mood and cognitive function, which can stave off feelings of loneliness. Nature wields healing powers that provide emotional, mental and physical relief.

You may not be able to maintain your exact exercise routine while traveling, but you can still squeeze in a daily 25 minute workout that will keep you feeling fit and refreshed.

Strength: Use Your Bodyweight as Resistance

Cardio: Follow the Tried and True

A new year, all new events. Check out what’s going on throughout Connecticut.

(OLP: original list price • LP: list price • SP: sale price • DOM: days on market)

| Address | Style | sq ft | BR | BA (f/h) | OLP | LP | SP | SP/OLP | DOM |

| 104 North St | Colonial | 5,337 | 4 | 2/2 | $1,195,000 | $995,000 | $950,000 | 79% | 65 |

| 70 Church Rd | Saltbox | 2,462 | 4 | 2/0 | $699,000 | $699,000 | $710,000 | 102% | 35 |

| 100 Ferndale Dr | Colonial, Contemporary | 3,868 | 4 | 3/1 | $799,000 | $799,000 | $845,000 | 106% | 17 |

| 81 Vista Dr | Ranch | 3,268 | 4 | 3/0 | $699,000 | $649,000 | $655,000 | 94% | 26 |

| 76 Beers Rd | Cape Cod | 1,966 | 4 | 2/0 | $595,000 | $595,000 | $600,000 | 101% | 27 |

| 38 Sanford Dr | Colonial | 3,714 | 4 | 3/1 | $939,000 | $939,000 | $1,172,000 | 125% | 20 |

| 35 West Rd | Colonial | 6,485 | 5 | 4/2 | $1,150,000 | $1,150,000 | $1,200,000 | 104% | 80 |

| Units Sold: 7 | $799,000 | $799,000 | $845,000 | 102% | 27 |

8/18: national couple’s day | 8/22: national tooth fairy day | 8/24: national waffle day | 8/25: national burger day | 8/26: national dog day | 8/28: national red wine day | 8/30: national beach day | 8/31: national eat outside day